The Current Situation, Problems and Countermeasures Concerning the Reform Towards the Marketization of Urban Public Utilities

Dec 13,2004

Chen Jinliang

Since China started reform and opening-up, the country has witnessed a rapid development in urbanization. The number of cities has risen from 193 in 1978 to 664 in 2001. The urban population has increased from 172.45 million to 480.64 million. At present, the urbanization level has reached around 37%. The rapid increase of the number and scale of cities has placed a great demand for urban utilities. [1]But due to a lack of government funds, the utilities investment system merely guided by government investment has made the urban utilities construction lag far behind economic development. At the same time, the existent urban utilities have not given full play to their efficiency due to the problems in the operation system. Inadequate utilities construction and low efficiency has become a "bottleneck" that hindering the sustained development of China’s economy. At present, the State has made it clear that the urban utilities construction and operation will be open to private and foreign investment in order to abandon the traditional government-dominated development pattern, build a structure of diversified investors and owners, introduce competition and quicken the construction and improve the efficiency of the country’s urban utilities.

I. The Current Situation of the Investment and Financing Concerning Basic Urban Facilities in China

Since the beginning of the 1990s, China has seen a rapid development of basic urban facilities with the total investment volume and proportion in the GDP of the same period tending to rise year on year. The annual statistical report of China’s urban construction indicates that during the Eighth Five-Year Plan, the total investment in the urban basic facility construction and maintenance was 260 billion yuan, which was 5.2 times as much as that during the Seventh Five-Year Plan. The total investment during the Ninth Five-Year Plan was 700 billion yuan, which was 2.7 times as much as that during the Eighth Five-Year Plan. In 2001, the total investment in the country’s basic facility construction and maintenance reached 250 million yuan, an increase of 34% over the year 2000. But its proportion in the GDP of the same period was fairly low. In the 1980s, it was only 0.4%. During the eighth and ninth five-year plans, it was respectively 0.8% and 1.7%. It hit 2% for the first time in 1999. In 2001, it reached 2.6%. The figure was still low compared with that of the foreign countries during their massive construction period – from 3% to 8%. (Current Situation and Reform Orientation of China’s Urban Utility Investment and Financing, Qin Hong, Ministry of Construction, March 2004)

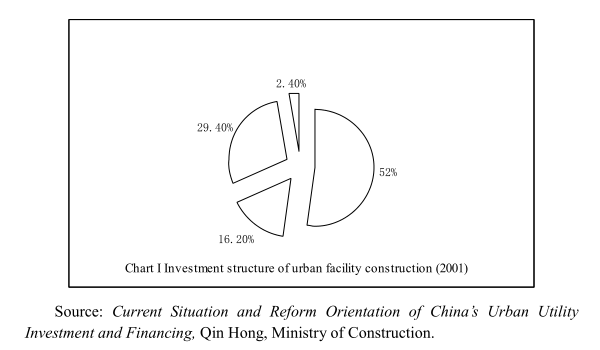

In terms of sources of funds (Chart 1), first, before 1995, the central government and local governments’ allocated money, "two items of fund" (urban maintenance tax and education surtax), and policy-based fees (including urban construction additional fee and capacity increment fee, highway toll fee, urban facility use fee and other fees -- after 1996, the government cancelled various kinds of improper charges to reduce the burden to enterprises.) made up more than 90% of the total investment in urban construction. With the deepening of the reform of public utilities marketization, the government fund support decreased to 52% in 2001 even including the treasury bond, land use right transfer income (In the mid- and late 1990s, with the spread and improvement of the system of non-gratuitous land use, most of the cities started to use the income from land use right transfer to make up for the shortage of urban construction funds. In recent years, some cities acted to increase the value of land through the land development and urban facility construction. The value-appreciated land will be offered for bidding or auction. Then the transfer income will be used for urban construction. This has given rise to a new development pattern under which urban construction and land use operation positively interacted) and the income from the operation of intangible assets. (In recent years, cities have sold, through bidding, the naming and advertising rights of the city roads, squares, green areas, lampposts, bridges and parking lots. The income will be used in the city’s basic construction. Second, with the reform of charging and pricing, the public utility enterprises have substantially increased the fund input to expand production with the funds they accumulated. This part accounted for 16.2% of the total in 2001, rising from 9% in 1992. Third, in 1986, only 320 million yuan of bank loans were used for urban construction, only accounting for 2.4% of the total funding. After the 14th Party Congress, the marketization process for public utilities has stepped up, and the pricing mechanism was basically established. The use of bank loans has been increasing rapidly. In 2001, more than 60% of the cities used bank loans for urban construction, totaling 74.2 billion yuan, making up 29.4% of the total investment. Fourth, in 2001, direct private and foreign investment has been attracted through the transfer of operating concessions (such as the taxi operation rights and bus line operating concessions), revitalizing stock assets (through the transfer of operating rights of fixed asset, of stock transfer and property transfer of toll ways, tap water plants and sewage treatment plants), BOT projects, issuing corporate bonds and listing on the stock market. The total amount was only 6 billion yuan, making up 2.4% of the total investment in that year.

China’s public utilities have developed rapidly, and the reform of marketization has achieved substantial progress. Compared with the traditional investment and financing pattern, the government is bearing a somewhat less direct financial burden. (The proportion of financial input decreased from more than 90% to 52% in 2001) But the direct use of private and foreign capital still makes up a very small proportion (only accounting for 2.4% of the total investment in urban construction). In view of the fact that the domestic bank loans are primarily based on the guarantee of the governments, which bear fairly high risks, the author believes that the government is still under direct and indirect pressure in raising funds for public utilities.

...

If you need the full context, please leave a message on the website.

--------------------------------------------------------------------------------

[1] According to the statistical standard of the Ministry of Construction, urban utilities refers to the construction, management and operation of such public facilities of urban water, heating and gas supplies, public transport, municipal engineering (roads, sewage facilities and public buildings), urban greening and environment and sanitation.