Judgment on Cyclical Development Trend of the Economy in 2005

Sep 01,2005

Yang Jianlong, Research Department of Industrial Economy of DRC Research Report No.095, 2005

In 2005, the basic performanceposture of China’s economic growth and industrial development will be subject to the joint impact of the cyclical economic fluctuations at three levels. The first is the new round of the economic growth cycle that has centered on the structural upgrading of personal consumption since 2001. The second is the economic boom cycle (trade cycle and investment cycle) arising from the fluctuations in the short and medium-term market demand. And the third is the economic fluctuation arising from macro policies and short-term shock factors.

I. The Driving Force for Medium and Long-Term Growth Is Still Strong

The Chinese economy entered a new round of growth around 2001. Compared with the preceding 20 years, the driving force for this new round of the growth cycle has been the structural upgrading of consumption, faster urbanization and speedier global industrial transfer and investment. This kind of driving force has clearerbetter market features and is stronger and sustainable. It has remained in a fine state despite the impact of the SARS epidemic, the shock of international oil prices and other factors.

First, the structural upgrading of consumption, which moves from meeting food and clothing requirements to satisfying the need of housing and transportation, has just begun in China. In light of the historical process of the United States, Japan and other developed countries and in consideration of the objective factors such as China’s huge economic scale and population, this period will last for a longer time. We believe it will be no less than 30 years. This will become one of the most basic forces to push forward China’s economic growth. It is expected that in the next 20 years, the structural upgrading of consumption spurred by growing personal income will contribute 3 to- 3.5 percentage points to the annual growth of the gross domestic product[1].

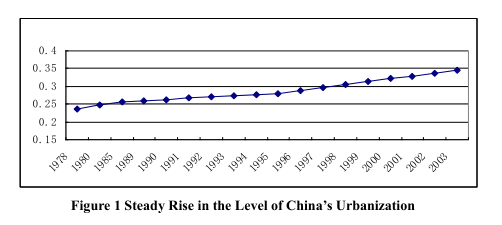

NextSecond, the accelerated pace of urbanization that began in the mid-1990s has lasted for nearly eight years. Driven by the huge growth inertia, this performanceposture is unlikely to be visibly changed by other factors in a short time. Therefore, we can expect that this process will continue to move forward and China’s level of urbanization may reach about 60 percent by the year 2020. This will produce a tremendous demand for infrastructure construction and speed up the structural upgrading of consumption, thus becoming another main factor to push forward China’s fast economic growth.

Third, the global industrial transfer and the rapid development of China’s manufacturing bases will provide fresh momentum to growth. This performanceposture has begun taking shape in the past few years. In addition to the traditional labor-intensive products, the export of machinery and electrical products has been growing at a noticeably faster speed, accounting for more than 60 percent of all exports. In the meantime, the growth of foreign direct investment in China has been dynamic thanks to the attraction of China’s large market and economic prosperity. China is beginning to become a manufacturing power in some new sectors such as automotive and iron and steel. This has not only satisfied the demands of fast domestic growth but also begun forming new export potentials. We believe this will become the third major force to push forward China’s economic growth.

Undoubtedly, the above three forces all have tangible long and medium-term features and enormous advancement inertia. Unless major strategic adjustments or major shock incidents occurred, the course of their push will not change and will continue to support a sustained and steady economic growth. The growth tracks of the three inter-related growth driving forces will together constitute a baseline for the cyclical fluctuations of the economic boom.

II. Consumption, Investment and Foreign Trade Are Likely to Resume Fast Growth

In addition to the long-term factors, the medium-term factors, mainly the troika of consumption, investment and foreign trade, are also building up strength.

1. The phasal intermittent adjustment of consumer demand will be completed within 2005.

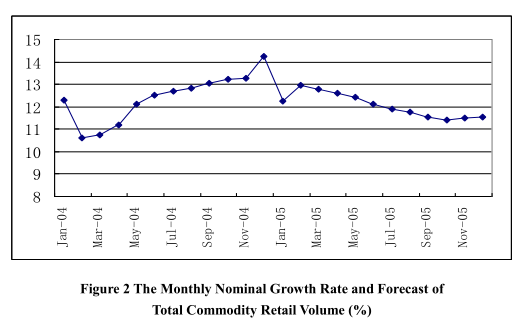

As figure 2 indicates, the growth rate of consumer demand has posted an intermittent fall after the explosive growth of consumer demand in 2003 and the first half of 2004. But the following points are noteworthy. In the first place, the fall in 2005 is to a large extent a result of underestimation because the growth base in the first half of 2004 was too high. Real growth remains relatively high. Secondly, the fundamental force to drive the growth of consumer demand lies in the steady income growth and the upbeat expectation of future income. In 2005, the momentum of personal income growth is still fairly strong. The salary raise for civil servants in some regions, the introduction of higher threshold forstarting point of taxation by the state and the easing of the employment pressure will all support a sustained and steady growth of disposable personal income, though in varying degrees. In consideration of all the above factors, we expect that in the first half of 2005 the growth of consumer demand will slow down from the level since the second half of 2004. In the second half of 2005 or near the end of the year, the slowdown in the growth of consumer demand will stabilize or even pick up due to the impact of the changes in the comparative base figures for 2004. The structural upgrading of personal consumption can pull the growth of consumer demand and will weaken the negative impact of the fluctuations of investment growth in a certain degree while continuing to push forward economic growth.

Model analysis indicates that the nominal growth of the total retail of consumer goods in 2005 will be about 15 percent, lower than the 18 percent nominal growth in 2004, and the real growth rate will be 13 percent. The overall growth performanceposture will post a turning point in the 4th quarter of 2005.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

[1]It is presumed that the pace of urbanization will be the same as in the past 10 years and in light of the strategic goal of quadrupling the GDP, per capita disposable personal income will increase by about 7.2 percent annually. In addition, if personal consumption maintains the steady growth trend formed in the past six years, the growth of personal income will contribute 3.5 percent to the GDP growth rate in the next 20 years.