An Overall Judgment of Economic Situation in 2007 and Prospect for 2008

Dec 10,2007

Task Force on Economic Situation Analysis, Development Research Center of the State Council*

China's economical performance has maintained a rapid growth with satisfactory economic returns this year and people have gained substantial benefits. The economic growth rate for this year is projected to be slightly higher than 11%. The steady rise of consumer price index (CPI) for the first three quarters is mainly driven by short-term fluctuations and cost increases in domestic and international agricultural markets and does not indicate deteriorating or reversing of overall supply and demand. The CPI for this year is estimated to be around 4%. Some tangible problems related to economic operation include slightly fast investment growth, excessive financial liquidity, slightly large trade surplus, significant increases in asset prices, and formidable tasks in energy conservation and emission reduction. While efforts are made to prevent the slightly fast growing economy from becoming overheated, attention should also be paid to addressing the uncertainty in external economic environment resulting from the U.S. subprime loan crisis in order to ward off the negative influence upon China's economical operation next year.

I. Analysis of CPI Rise in 2007

The most prominent issue in 2007 economic operation is the noticeable CPI rise. The attempt to objectively analyze the contributing reasons will enable us to obtain accurate judgment of the situation, draw lessons from experience, and improve prediction in macro economic control.

1. The present structural consumer price rise is triggered off by price increase of some foodstuffs

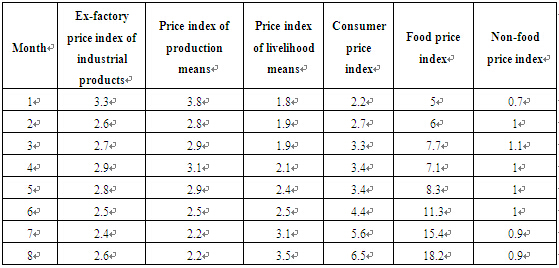

From January to August, the CPI has seen a year-on-year growth of 3.9% and in August it jumped by 6.5%, registering the highest increase since 1997. The direct cause has been significant price increase in some foodstuffs. In view of changes in main price indices (shown in the table below), while production means among industrial products have witnessed a slowing down momentum of growth, livelihood means which are closely associated with foodstuffs keep growing. Since foodstuffs represent a relatively small share in all national products, the ex-factory price indices of industrial products (including price indices of both production means and livelihood means) show a general downward development. Non-food price indices among CPI stay at 1% and are relatively stable; food price indices have been on the steady increase, hiking up CPI. However, price increase of foodstuffs is not widely sweeping, as only stable foodstuffs, such as oil & fat, meats, eggs, and fresh vegetables have seen marked price growth (being 34.6%, 49%, 23.6%, and 22.5%, respectively in August).

Main Price Indices from Jan. to Aug. 2007 (month-on-month comparison, %)

2. The total social supply and demand are fundamentally balanced and price increase in foodstuffs will not trigger off a widespread price rise

The priority of macro economic policies from 2003 has been focused on curbing excessively fast growth of investment demand and stimulating domestic consumption, with positive achievements scored ever since. In 2006, efforts were initiated to control growth of exports, especially export of resource-processed products and highly energy-consuming and highly environment-polluting products and to stabilize external demands. The efforts have been very effective. Meanwhile, basic activities and supply of stable commodities have speeded up. For the period 2003~2006, installed generating capacity grew by 59%, coal by 43%, freight traffic by 27.6%, crude steel by 91%, and non-ferrous metal by 56%. The rapid growth of raw coal, generating capacity, pig iron, crude steel, and steel products has continued into this year.

The growing demands of investment, consumption and export are projected to level off or slow down slightly. Firstly, with earnest efforts made to implement the current macro economic policies, there is low likelihood of investment rebound. Secondly, as the consumption demand depends upon resident income level, income expectation and family budget, it does not undergo big fluctuations easily. Thirdly, the gradual appreciation of RMB and growingly visible role of policies governing export of resource-processed products and highly energy-consuming and highly environment-polluting products are expected to decelerate the export growth.

Against the backdrop of increasingly stable growth of demand and beefing-up supply capability, the supply-demand aggregate relation is moving towards fundamental equilibrium or a situation where there exists partial surplus capacity. Besides, while prices of production means fall back, the pressure felt by downstream products to increase their prices are reduced. Hence, price increases of foodstuffs will not lead to a wide-ranging scope or a long lasting period.

3. Large-scale price increase in foodstuffs mirror new problems in production and circulation of agricultural products

Prominent problems include: first, increased agricultural production costs contrast sharply with low comparative advantage. While production costs for labor, production means and land are on the rise, prices of agricultural products are in downturn, constituting increasingly worse comparative advantage of agricultural production. Secondly, intensified fluctuations in agricultural product market are encouraged by lack of a risk dispersed mechanism. When production activities of agricultural and animal husbandry products are vulnerable to attacks from natural disasters and epidemics, an unsound risk dispersed mechanism will lead to frequent big-scale fluctuations. Particularly, fluctuations in international markets have exerted increasing influence upon domestic agricultural product markets since China's admission to WTO. Thirdly, backward agricultural production and operation and circulation have presented serious problems. The household-based small-scale farming and production practice suffers from low specialization and low systematization; the out-of-date logistics system and trade modes of agricultural products, asymmetrical market information, unmatched production and marketing performance will jointly stimulate or restrain production in an improper way, causing big rises or falls in prices. Take live pigs as example. After the year 2003, more live pigs were raised, pulling down the purchasing price once to 2.7 yuan for half a kilo and making the pig-raising attempt a loss-making business. Later, with increasing risks of epidemics and diseases, the number of pigs raised saw a plunge across the country, contributing to the significant rise of meat price this year. The rising price and backup from the State's policies can once again lead to excess production of pigs and a spectacular price dive in the second half of 2008. Fourthly, the supply-demand relation of agricultural products is under pressure and a few products have seen an obvious disequilibrium. The pace-gathering national economy has piled up pressure upon agricultural product markets and the situation in which “staple agricultural products are in fundamental equilibrium and surplus can be expected in a bumper harvest year” begins to collapse. While the equilibrium of grain supply and demand is under increasing pressure, most agricultural products are in tightened supply-demand relation and particularly, soybeans and vegetable oils are undersupplied, showing a heavy dependence upon international markets.

During the period of swift industrialization and urbanization, periodical fluctuations of agricultural products (especially foodstuffs) will exist for a long time and price rise will appear as a trend pattern. This will be good for bridging rural and urban gaps and helping farmers improve income. But the pressing issues lie in how to adapt to changes in agricultural product supply and demand relation and in circulation pattern of food markets, how to improve production and circulation practices of agricultural products and how to stabilize food prices.

...

If you need the full context, please leave a message on the website.

* The principal investigators of the task force include Li Jiange & Jin Renqing; the paper is based on group discussions and jointly contributed by Li Jiange, Lu Zhongyuan, Zhang Liqun, Li Jianwei and Chen Changsheng. Some of the data are provided by Han Jun, Long Guoqiang, Liao Yingmin and Fan Jianjun.