Innovation in China's Pharmaceutical Industry: Obstacles and Policy Suggestions

Dec 10,2007

—— Based on a questionnaire on 230 pharmaceutical enterprises

By Wei Jigang, Research Department of Industrial Economy of DRC

Research Report No. 161, 2007

I. Extreme Insufficiency of Efforts on Innovation in China's Pharmaceutical Industry

Commonly acknowledged in the world as a hi-tech industry with great development prospects, the pharmaceutical industry is characteristic of fast growth, enormous investment, substantive returns, high risks, high degree of internationalization, marked effects of scale economy, significant spillover effects, and strict government control. The industry plays a significant role in promoting economic and social development.

Since the founding of the People's Republic of China in 1949, and especially over the recent 20-odd years after the country initiated the policy of reform and opening-up, China's pharmaceutical industry has maintained a fast pace of growth. By now, China has become a major producer and exporter of raw medicines and the biggest producer of pharmaceutical preparations and vaccines in the world. It takes an important position in the world raw medicine market. Between the 1950s and the 1960s, China independently developed some innovative drugs1 with international influences, including sodium dimercaptosucinate and artemisinin. Innovation in China's pharmaceutical industry as a whole, however, has not moved to a noticeably higher level along with the fast expansion of its production scale. On the contrary, it has contributed few patent medicines with proprietary intellectual property right (IPR) and no innovative drug with international influences in the Western medicine market which dominates the world pharmaceutical market. According to data from the State Intellectual Property Office of China, among the 212 brands of chemical medicines with proprietary IPR which passed examination and approval between 2003 and 2005, only 17 were really chemical entities. Even when added together with 22 traditional Chinese medicines, they made up a mere 0.39 per cent of the over ten thousand new medicines approved in China during the period. A joint survey of China's 230 pharmaceutical enterprises jointly conducted by the Research Department of Industrial Economy of the Development Research Center of the State Council, the Economic Construction Department of the Ministry of Finance, and the Department of Industry and Transport Statistics of the National Bureau of Statistics of China in 2006 has also revealed that only 3 per cent of these enterprises counted themselves as having carried out or are carrying out development of medicines that were ‘new' in a world perspective.

Against the background of rapid development of economic globalization, competition in the pharmaceutical industry has become increasingly intense and development of new medicines has become one of the focuses in the new round of competitions between various countries in the world. European and US pharmaceutical enterprises have been stepping up development of new medicines for the purpose of seizing command posts in the international pharmaceutical market. Without speeding up the development of new eutherapeutic medicines with little toxic effects, minimal side effects and reasonable price, it will be very difficult for China's pharmaceutical industry to achieve its strategy goal of turning from a big producer to a competitive producer. Besides, the share of local producers is highly likely to shrink further in the Chinese pharmaceutical market. By now, over half of the Chinese pharmaceutical market has been taken by imported medicines and products from foreign-invested enterprises. It is high time for the government to look at the issue of innovation in the pharmaceutical industry from the strategic perspective of maintaining national security and improving overall national competitiveness.

On the basis of an in-depth investigation on the situation of technical innovation in 230 pharmaceutical enterprises in the country, and by taking into account the mechanisms and systems currently serving the industry's development, this paper tries to analyze the main factors leading to the extremely insufficient efforts on innovation in China's pharmaceutical industry and put forward some pertinent policy suggestions.

II. Major Factors Leading to the Extremely Insufficient Efforts by China's Pharmaceutical Industry in Innovation

1. Immediate factors: extreme shortages of fund, technology and manpower, and inappropriate organization

In order to invent new medicines, a pharmaceutical enterprise has to put in and rationally integrate many key elements including fund, technology, manpower, and organization in line with the features of the medicine to be developed. Any shortage of these elements may directly lead to failure or termination of the innovation process.

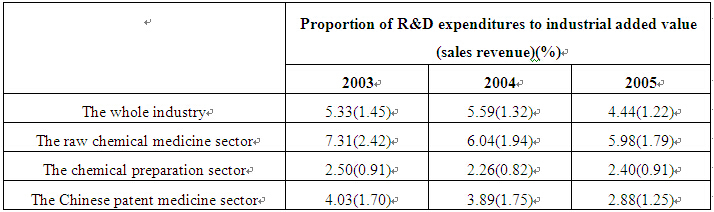

(1) Excessively low level of R&D intensity. The R&D intensity level of China's pharmaceutical industry is not only well below that of developed countries, but is also lower than some developing countries such as India. What is worse, the intensity has been decreasing continuously in recent years, which is considerably deviating from the general international trend. According to the Statistical Data of Hi-tech Industries in China, 2006, the R&D expenditure of Britain's pharmaceutical industry accounted for 52.4 per cent of its total industrial added value, and the corresponding figures in France, Japan, and the United States stood at 27.2, 27.0 and 21.1 per cent respectively. If measured by the ratio of R&D expenditures to sales revenues, the R&D intensity of the pharmaceutical industries of developed countries usually stands at above 15-20 per cent. Even in such a developing country as India, the figure reached 10-12 per cent in 2006. Against the background of fierce competition in the world pharmaceutical market, developed countries have followed each other to intensify R&D. Just 14 years ago, there was not a single pharmaceutical enterprise in the world's top 20 enterprises with biggest R&D expenditures. By now, however, six have been listed.2 From 2003 to 2005, China's pharmaceutical industry suffered a continuous decline in R&D intensity, with its R&D expenditure accounting for merely 4.44 per cent of the industrial added value and 1.22 per cent of the sales revenues in 20053. Both were much smaller than the world average. Table 1 shows the changes in the R&D intensity of China's pharmaceutical industry between 2003 and 2005.

Table 1 Basic Situation of R&D Spending by China's Pharmaceutical Industry

(2) Low technology level of the pharmaceutical industry as a whole, and shortage of scientific and technical personnel

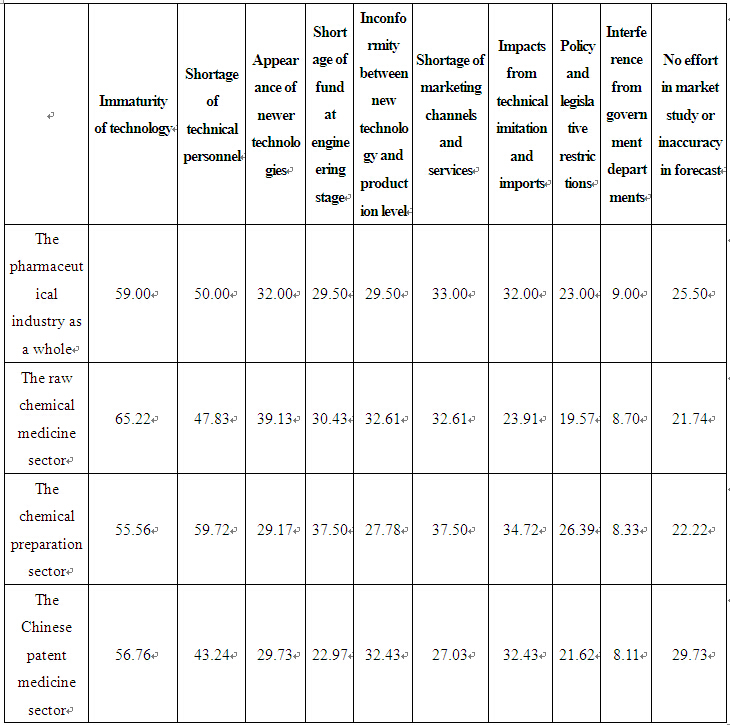

The questionnaire revealed that immaturity of technology is mainly to blame for termination or failure of innovative efforts, a fact acknowledged by 59 per cent of the sample enterprises, as shown in Table 2 below.

Immaturity of technology has resulted mainly from the following three factors: First, there is insufficient technology accumulation and the overall technical level of the industry still remains at the stage of imitation; second, technological uncertainty and risk in developing new medicines have kept enterprises from accepting funding and investing in innovation, which in turn has prevented the timely industrialization of many R&D results; third, enterprises are short of qualified technical personnel, especially those with true innovative abilities. Development of new medicines requires integration of different disciplines and joint efforts by researchers and specialists in different fields. However, most of the scientific and technical personnel in the sample enterprises are engaged with technical renovations, and some technical personnel even have been transferred to business operations in quite a number of cases. The investigation has revealed that the number of R&D personnel employed by the pharmaceutical enterprises in China accounted for less than 4 per cent of their total work force on average (see Table 3). In comparison, the corresponding figures for pharmaceutical enterprises in developed countries such as Europe, the United States and Japan are about 30%.

Table 2 Factors Leading to Termination or Failure of Technical Innovations in China's Pharmaceutical Enterprises (%)

1Generally speaking, innovative drugs shall meet the following three requirements: being considered as the best so far in the world; being regarded as the first independently invented one in the world; other countries are willing to introduce and imitate this drug.

2From International Technology and Economy Gazette, the second issue, 2007.

31.02 per cent by China Pharmaceutical Industry Association.