Internationalized Operation of China’s Enterprises: Preliminary Observation and Suggestion

Dec 13,2006

Research Team on "Study of Chinese Enterprise Internationalization" of the Enterprise Research Institute, the DRC

The internationalized operation of China’s enterprises is gaining an increasing attention. This project team emphasizes the study from the strategic perspective of corporate, applies the study methods as material sorting, questionnaire survey and enterprise interview, and some preliminary research findings have been achieved.

I. Most of Large-scale Enterprises in China Have Started Their Internationalized Operations, and Some Have Begun Their Transnational Operationsand EvenGlobalized Operations

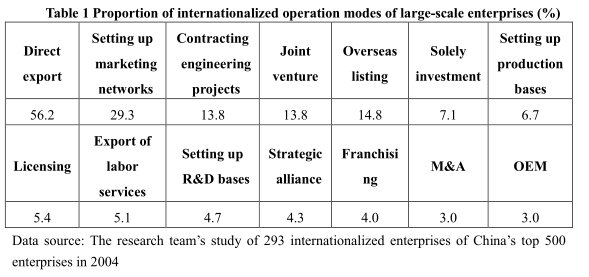

An increasing number of China’s enterprises has started their overseas business. This research team analyzed the data of China’s top 500 enterprises, and found that about 60% of these enterprises had already carried out their overseas business activities in different forms before the year of 2005, and the most common method is direct exports, and coming next is to establish overseas marketing networks (See Table 1). In the highly internationalized industries, a few big enterprises have made the turnovers from overseas market exceeding their domestic turnovers, and they have several or dozens of production, R & D, marketing and trading organizations overseas, such as Lenovo, TCL and Huawei in the IT industry.

According to the indices such as the proportion of overseas turnovers in the company’s total turnovers, global resources distribution and operational capability, enterprises’ overseas operation could be classified into three stages – internationalized, transnational and globalized operations. This project team, through its preliminary study, holds that China’s enterprises with overseas operation are basically at the primary internationalized stage, a small portion of enterprises has started their transnational operation, and of them, a few enterprises have moved into the primary stage of globalized operation.

The level of overseas operation of China’s enterprises shows a fairly remarkable difference in industrial distribution. Enterprises at the stage of internationalized or primarily internationalized operations are widely distributed among the industries, and some highly export-oriented enterprises in all industries are almost at this stage, but enterprises in different industries show different characteristics. In the light industry such as textile and garment and some electromechanical industries, many enterprises’ proportions of their overseas market have grown considerably, many enterprises have their own independent departments responsible directly for their exports, and some enterprises have their own overseas marketing outlets and have invested in the construction of overseas plants. Of China’s energy, steel, and chemical industries, some large-scale enterprises have invested in overseas resource bases, many enterprises are conducting export and overseas operations, but they still mainly focus on the domestic market at present. In the service industry such as transportation, telecommunications and trade, some large-scale companies have many overseas network outlets and business activities, their main businesses, however, are still serving the domestic enterprises for the time being.

Enterprises already starting transnational operations are mainly distributed in the industries which are highly internationalized and in which China’s enterprises have fairly strong comparative advantages and competitiveness. The overseas business activities of some enterprises in these industries have accounted for a big proportion of total businesses, and they have established their marketing service and manufacturing networks overseas to mainly serve the local market. IT, electronic, electromechanical and construction industries fall into this category. China’s enterprises in this category are usually highly competitive on the matured overseas middle and low-grade market, and could independently operate on the overseas market.

According to the proportion of turnovers from overseas market, and the amount and depth of their overseas marketing and manufacturing networks, a small number of large enterprises in China’s IT, electronic and electromechanical industries are already in or begin to move into the stage of globalized operation. Judging from their organizational system and capability of utilizing global resources, however, these enterprises could be rated only as the ones beginning to carry out globalized operation. Large enterprises as Lenovo, Huawei, TCL and Haier in the IT and electronic industries and Wanxiang in the automobile parts industry are actually pioneering enterprises in the move of China’s enterprises for globalized operations. Of them, Lenovo, TCL and Haier have all carried out merger and acquisition activities on the overseas market, and Wanxiang has begun to make investment overseas from 1992 and has acquired and merged several enterprises and channels in the relevant industries.

II. The Reason Why China’s Enterprises Carry out Transnational Merger and Acquisition: An Observation and Preliminary Analysis

Transnational M&A is an important way for enterprises to carry out transnational operations and globalized operations. In recent years, China’s enterprises, especially for those enterprises in the automobile, IT, electronic, energy and steel industries, have started to conduct transnational M&A on a large scale. Transnational M&A by enterprises in the energy and steel industries is mainly to obtain natural resources, and transnational M&A by enterprises in the automobile industry is mainly to acquire technology and manufacturing capability. For the M&A activities by these enterprises, particularly M&A activities for the purpose of obtaining natural resources, the majority of domestic people could understand their motivations and conditions, and show their concerns over the issue of price and integration. For the transnational M&A by enterprises in the IT industry, because they mainly target at the overseas market and mainly acquire intangible assets such as brands, channels and R&D teams, or in other words, soft assets, people in China have greater worries and have different opinions on these activities.

Some people believe that IT enterprises should first gain bigger domestic market shares, including the high-end market share, and then conduct transnational M&A activities. Some believe that the M&A of transnational corporations’ business operations by Chinese enterprises is a "frog-leap", and the normal process should be exports → establishment of overseas marketing networks → establishment of overseas plants → development or M&A. It is found through the typical surveys on IT enterprises that the transnational M&A by Chinese enterprises is mainly to acquire market (clients, channels), and then strategic assets (including technology, brands, local service capability, manufacturing capability, intellectual property rights and R&D capability) and efficiency of large scale production ( synergetic effect). Those M&A activities are mainly M&A in terms of stock and assets, but in essence, a strategic alliance is formed. It is reflected by the fact that the two parties usually maintain a share-right relationship after M&A, and the senior managements from both parties jointly form the senior management of the new company, and it is mainly a "friendly M&A." The Wanxiang Company in the automobile parts industry conducted several overseas M&A, for expanding and accumulating knowledge about the overseas market, including enhancing its technological capabilities. The companies claim that transnational M&A are ways to cooperate with foreign companies.

According to the preliminary study on the motivation or driving factors of China’s large enterprises’ overseas operations, China’s large enterprises conduct overseas M&A mainly aimed at obtaining market share and strategic assets, and improving efficiency (See Table 2), which enjoy the similar motivation of the IT enterprises’ overseas M&A. Why do IT enterprises, particularly advanced enterprises among them, begin to conduct overseas M&A before building a stronger foothold on the domestic market? The preliminary analysis of China’s IT enterprises found that there are three major reasons for China’s enterprises to begin transnational M&A before becoming stronger on the domestic market: China’s enterprises’ certain comparative advantages in some fields, strategic choice conform to the changes in industrial environment, and the awareness and entrepreneurship to seize the globalized opportunities.

…

If you need the full text, please leave a message on the website.