Earnestly Promoting Structural Adjustment and Stipulating Consumption Demand

Mar 15,2006

By Ren Xinzhou

Research Report No 009, 2006

I. Economy Continued to Maintain a Good Momentum of Growth in 2005

1. The national economy continued its steady and rapid growth

In 2005, the GDP showed a trend of high and steady growth. The annual GDP reached 18.2321 trillion yuan calculated at comparable price, an increase of 9.9% year on year, which is slightly lower than the growth of 10.1% of 2004. China’s industry above designated scale realized an accumulated amount of added value totaling 6.6425 trillion yuan, an increase of 16.4% year on year and a drop of 0.3 percentage points over the previous year; the production-sale rate of industrial enterprises above designated scale was 98.1%, the same level as in the previous year; the contribution rate of industrial total assets was 12.17%, an increase of 0.28 percentage points year on year; the turnover rate of current assets in the year was 2.23 times, faster by 0.15 times year on year.

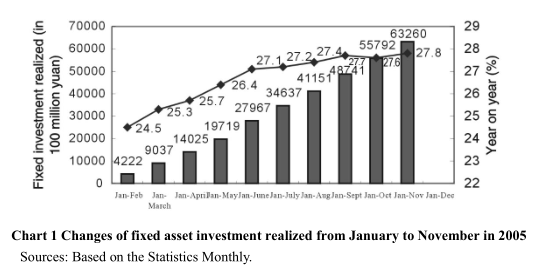

2.The growth rate of investment in fixed assets accelerated quarter by quarter, and investment structure was slightly improved

In 2005, China’s investment in fixed assets reached 8.8604 trillion yuan, an increase of 25.7% year on year, a drop of 0.9 percentage points over the previous year. Out of that, investment in urban fixed assets amounted to 7.5096 trillion yuan, an increase of 27.8% and a drop of 1.3 percentage points (see Chart 1), and the growth rate showed an accelerating trend quarter by quarter. Investment structure continued to improve. From January to November, investment in coal mining, washing and dressing industry increased by 75.5% year on year, the investment in petroleum and natural gas exploiting industry grew up by 27.3%, the investment in railway transport industry grew up by 38.3%, the investment in electric power, gas and water production and supply increased by 31.8%; and investment in the equipment and manufacturing industry was strengthened.

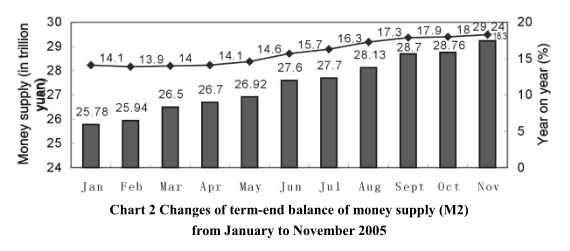

3. Money supply and credit grew fast

By the end of 2005, the balance amount of broad money supply (M2) was 29.87 trillion yuan, an increase of 17.6% year on year, the growth rate was 3 percentage points higher than the same period of the previous year. This growth rate was higher than the anticipated goal (see Chart 2). The supply of narrow money (M1) was 10.4 trillion yuan, an increase of 11.8% year on year, a drop of 1.8 percentage points over the previous year. The money in circulation (M0) stood at 2.4 trillion yuan, an increase of 11.9%, or 3.2 percentage points faster over the previous year.

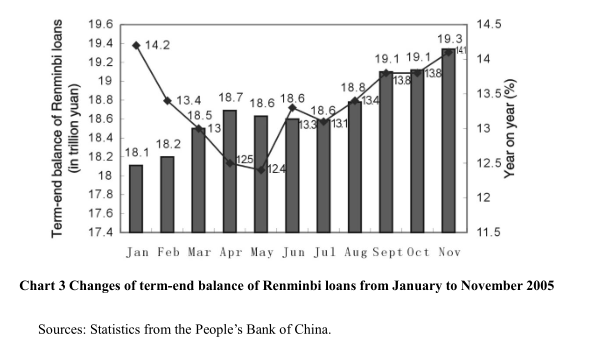

At the end of December, the total loans by all financial institutions were increased by 2.3544 trillion yuan over the beginning of the year, an increase of 87.1 billion yuan year on year. The balance of Renminbi loans was 19.47 trillion yuan, an increase of 14.2% year on year. (See Chart 3).

4. Incomes of residents increased by a big margin, and consumption grew steadily

In 2005, the per-capita disposable income of urban residents was 10,493 yuan after deducting the price factor, up 9.6% year on year and an increase of 1.9 percentage points over the previous year; per-capita cash income of farmers was 3,255 yuan, up 6.2% year on year after deducting the price factor, a drop of 0.6 percentage points. In 2005, the total retail volume of social consumer goods was 6.7177 trillion yuan, up 12.9% year on year and a real increase of 12.0% after deducting the price factor or 1.8 percentage points faster over the previous year. In 2005, the price of fixed assets investment rose by 1.6%.

5. The consumer price rise declined month by month, and the ex-factory price slowed down

In 2005, the consumer price index of residents (CPI) rose 1.8% year on year, a drop of 2.1 percentage points year on year. New factors of price rise were about 1.2 percentage points, and the carryover factors were about 0.6 percentage points. In terms of the structure of price rise, the rising rates of housing and food prices were 5.4% and 2.9% respectively year on year and were the main factors driving up the CPI; the prices of entertainment, education, culture and services rose 2.2%, and the rising rate was obviously higher that the 1.2% during the same period of the previous year.

The increase of the ex-factory price index eased gradually quarter by quarter. In the first half of the year, the ex-factor price index rose 5.2% year on year (in May, the increase was 5.9%), the purchase price of raw materials, fuels and power rose 9.0%, although the rising rate slowed down somewhat from that of the previous year, it was still hovering at a high rate. From January to November, the EPI rose 5.1% year on year, and the increase in November was 3.2%, showing an obvious drop compared with the first half of the year.

6. With an annual bumper harvest of grains, farmers’ income grew rapidly

2005 witnessed a bumper harvest of grains with a total output of 484.0 billion kilograms, an increase of 3.1%. The output of summer grain reached 106.25 billion kilograms, an increase of 5.1% over the previous year; autumn crops reached 3459.5 billion kilograms, an increase of 2.9%. The shortage in the grain supply has been further narrowed.

7. Export grew fast and foreign exchange reserves increased by a big margin

In 2005, the total volume of import and export was 1.4221 trillion US dollars, an increase of 23.2% year on year, a drop of 12.5 percentage points over the previous year. Export increased 28.4% and import grew 17.6%. The trade surplus was 101.9 billion US dollars, an increase of 69.9 billion US dollars compared with the same period of the previous year. By the end of 2005, foreign exchange reserves amounted to 818.9 billion US dollars, an increase of 208.9 billion US dollars compared with the amount at the end of the previous year. The actually used foreign capital was 60.3 billion US dollars, a drop of 0.5% year on year.

According to the analysis of the 2005 market performance and by taking other factors into consideration, our basic conclusions are: The national economy will continue to maintain a trend of steady and fast growth. With the "double stable" policies of fiscal and monetary policies implemented by the central government and the achievements made in solving the acute problems in the economic operations, the overall effect of macro adjustment policy will become more tangible. At present, the economy has the feature of "high yet steady" growth rates, the growth rates of GDP and investment are all high and steady, consumption demand grows steadily, and the CPI rises mildly. China’s economy is, generally speaking, in the stage of steady and fast growth. There is no obvious indication of inflation or deflation, but some problems deserve our high attention.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

[1]This paper is a summary of the Report Analysis of China’s Market Situation in 2005 and Forecast for 2006 by the Institute of Market Economy of DRC.