An Analysis of the Market Situation in 2006 and a Forecast for 2007 *

Mar 22,2007

By Ren Xingzhou, Institute of Market Economy of DRC

Research Report No.329, 2006

I. The Overall Situation of Economic Performance in 2006

1. The basic situation and characteristics of the performance of national economy

(1) The fastest economic growth of national economy in the past decade has been achieved

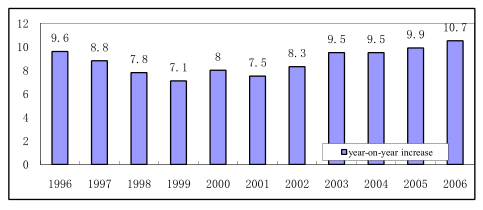

In 2006, the national economy maintained a fast growth. The total annual GDP was 20940.7 billion yuan, representing an increase of 10.7% year on year, which is expected to be the fastest annual growth in the past ten years (See Chart 1). The industrial added value by enterprises above designated size grew year-on-year by 16.6%. The sales ratio of industrial enterprises was 98.1%. The year-on-year increase of profit by enterprises above designated size in the country was 31.0%. Agricultural sector witnessed the third year of output increase. The summer crops totaled 113.8 billion kg, a growth of 7%. The annual grain output exceeded 980 billion jin, a growth of 2.48% over last year as the annual demand and supply has been basically balanced.

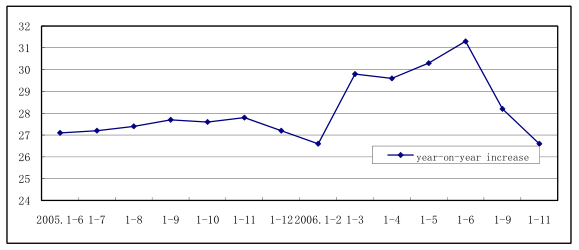

(2)The fixed-asset increase has maintained a high, sustained and fast growth

The annual urban investment in fixed assets amounted to a volume of 9347.2 billion yuan, which was a year-on-year increase of 24.5 percent. (See Chart 2). The investment mix continued to improve. In the first 11 months, the investment in real estate grew year on year by 24.0%; the investment in coal mining and dressing rose year on year by 28.9%; the investment in power and thermal power production and supply increased by 13.5%; the investment in petroleum and natural gas production grew by 29.1%; the fastest growth was seen in the investment in railway transportation, which stood at 105.1%; the investment in the mining and processing of non-ferrous metal ores and smelting and pressing rose by 35.0%; and the investment in the mining and processing of ferrous metal ores as well as smelting and pressing grew by 4 .0%.

Chart 1 Year-on-year increase of GDP from 1996 to 2006

Source: The data of the National Bureau of Statistics. The figure for 2006 is an estimated one.

Chart 2 The year-on-year growth of fixed asset investment from the latter half

of 2005 to 2006

Source: China Monthly Economic Indicators

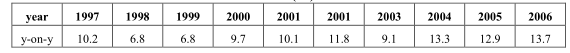

(3)Consumer demand has increased by the largest margin in the decade

Total retail sales of consumer goods in 2006 rose year-on year by 13.7%, an increase of 0.8 percentage points.Out of that, the urban retail sales of consumer goods rose by 14. 3% year on year while those of and below the county-level rose by 12.6% year on year, which represented the maximum growth rate in the past decade (See Table 1). This was much faster than the annual growth rate of 11.5% from 1979 to 2005.

Table 1 The year-on-year growth of aggregate retail of social consumption products since 1997 (%)

(4)CPI has risen moderately in the year as the ex-factory price of industrial products has remained relatively stable.

In 2006, the CPI rose moderately in general with an annual growth rate of around 1.5%, which fell by 0.3 percentage points over last year. Due to the rise of grain price in the fourth quater of the year, the total level of consumer price rose by 1.9% and 2.8% in November and December respectively year on year. The consumer price rose by 1.5% in cities and in the countryside. The food and housing prices were the main factors leading to the rise of CPI in 2006.

The ex-factory price of industrial products rose by 3.0% over the same period of last year while the purchase prices of raw materials, fuels and power increased by 6.0%, which were relatively stable. But it should be noted that the prices of production materials are affecting the prices of commodities and services more and more directly. Affected by the rise of international prices of crude oil, the state adjusted the prices of product oil. In November, the prices of gasoline, kerosene and diesel oil increased by 12.9%, 12.2% and 10.6% respectively. The purchase prices of fuel and power, non-ferrous materials and chemical materials rose by 4.0%, 36.3% and 4.3% respectively. As the enterprises have less room to adapt to the price hikes, the price rises of raw materials will have a more and more immediate impact over the prices of commodities and services.

2.The market performance of main sectors have been fairly stably, and the price fluctuation has tended to be eased up.

(1) The supply and demand on the energy market has been improved and the price rise has come down

From January to October, the energy production totaled 1.6176952 billion tons of coal equivalent (tce), a year-on-year growth of 10.2%. The increase rate fell by 1.2 percentage points compared with the first half of the year. The total outputs of coal, crude oil and electricity grew respectively by 12.2%, 1.5% and 13.0%. The growth rate of coal output fell by 0.6 percentage points over the first half of the year; the growth rate of power generated rose by 1 percentage point. Structurally speaking, the demand for coal in 2006 was strong, and coal production increased rapidly. In the second half of the year, the coal supply was fairly sufficient as the inventory grew by 8.2% compared with that in the beginning of the year. It is expected that the annual newly added installed power generation capacity is around 80 million kw, representing a period with the fastest growth of production capacity. In the second half of the year, the domestic consumption of crude oil, gasoline and diesel oil had grew more slowly than in the first six months as the short supply of resources had gradually been improved. With the decline of international prices of crude oil, the inventory of gasoline and diesel oil had reached the highest level by the end of September.

Since 2006, the price hike of energy products tended to fall. In the second half of the year, the coal price rise grew more slowly year on year. But after September, it rose back by 2.82%. With the drastic fall of international oil prices in the second half of the year, the domestic prices of crude oil and product oil also dropped drastically. In October, the ex-factory prices of crude oil and product oil fell to the lowest level in the year. As the electricity price in June grew by 2.5 fen for one kwh on average, the sales prices of electricity rose year on year drastically. It rose by 4.6% in July.

...

If you need the full context, please leave a message on the website.

--------------------------------------------------------------------------------

*This is the general report on "An Analysis of the Market Situation in China in 2006 and the Forecast for 2007" by the Institute of Market Economy.