The Judgment and Policy Suggestions by Enterprise Operators over Macro Economic Situation*

Mar 31,2007

By China EntrepreneursSurvey System

Research Report No.284, 2006

In the "Survey of Chinese Enterprise Operators 2006", the China Entrepreneurs Survey System, under the Human Resources Research and Training Centre of the Development Research Centre of the State Council sent out 13,000 copies of questionnaires on August 10, 2006 and collected 4,586 valid copies. The collected copies came from enterprises of various sectors in 31 provinces, autonomous regions and municipalities other than Hong Kong, Macao and Taiwan. The state-owned and non-state-owned enterprises involved made up 12.8% and 87.2% respectively. The large, medium and small-sized enterprises accounted for 12.4%, 45.2% and 42.4%. Those who hold the positions of chairman of board of directors, general managers, factory chief or Party secretary occupied 93.3%.

I. Macro Economic Performance Is Sound

1. Economic performance is fairly satisfactory, but it tends to be heated

On the macro economic situation, the survey finds that 70.9% of the surveyed believed that the situation was "good" or "fairly good", and 26.3% believed that it was "so-so"; only 2.8% of them said it was "fairly bad" or "very bad".

The judgment over the trend of economic growth and CPI can also show their degree of satisfaction over current situations. The survey shows that more than half of the entrepreneurs expected that the GDP in 2006 would exceed 10%; 39.3% believed it would be 9.5% to 10%; nearly two-thirds of them estimated that the CPI in 2006 would be between 1% and 2%; 24.2% said it was between 2%-3%. The questionnaires find that the surveyed were fairly satisfied with the current macro economic situations.

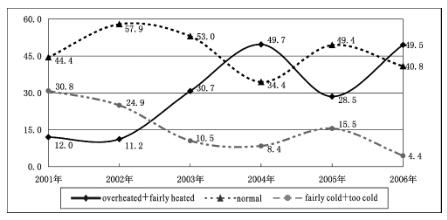

On the macro economic operations, the survey shows that 3.8% of the entrepreneurs believed that the economy was "too hot", while 44.9% believed it was "fairly heated", the rates rising respectively by 1.2 and 19 percentage points over 2005. The judgment returned to that over 2004 situation when the economy was regarded as being "overheated". About 42% of the surveyed believed that the economy was "normal" and 4.4% said it was "tending to be cool", with the percentage points being relatively declining by 7.4 and 10.5 percentage points over 2005. It should be noted that 55.6% of the state-owned and state-holding enterprise leaders believed that the economy "was overheated" or "fairly heated", 10.3 percentage points more than those of private enterprises (See chart below).

Chart 1 The overall judgment of enterprise operators over macro economy from 2001 to 2006 (%)

The survey finds that the overheated economy was somewhat cooled down in 2005 after a series of macro regulative measures were taken from 2004 to 2005. With more or less relaxation of macro control, the economy was heated up in 2006 as the country entered the first year of the 11thFive-Year Plan and various regions were eager to boost economic development.

The short supply of land, coal, power, fuel and transportation also revealed the heat of economic operations. The survey shows that the resources, especially petroleum and land supply were in short supply. Some 62.7% of the surveyed believed that petroleum shortage was "even more serious". More than half of them believed that land shortage was "more serious". Coal supply was believed to "tend to be better than 2005", but those chose "more serious" are over 10% more than those who believed it "tended to be eased". Like the previous years, most enterprise operators believed that the railway transport shortage "did not change much". It indicated that transport shortage had not obviously changed for the better.

As a result of a fast growth of production capacity, the shortage of power and steel tended to be eased. The survey finds that 44.8% of the survey respondents believed that the power supply "tended to improve", 17.1 percentage points more than 2005; 44.2% believed that the supply of steel "tended to improve."

2. The demand for investment and exports is strong while the consumption demand is inadequate

The questionnaires show that in 2006, the investment demand from the governments and private sectors and export demand reached the highest level in the past six years, but the consumption demand seemed to be inadequate.

In terms of investment demand, the survey shows that 56.6% of the respondents believed that the government investment demand was "very strong" or "fairly strong". Those who believed that private investment was "very strong" or "fairly strong" made up 53.4%. In terms of export demand, nearly half of the surveyed believed that export demand was "fairly strong" or "very strong". On the export situations of their enterprises, 41% believed that enterprises "increased" exports; 17.8% "reduced" exports. But differences existed in different regions in terms of scale and type of enterprises and industries.

On consumption demand, the survey shows that 41.2% believed that the demand was "not sufficient" or "seriously inadequate", 14.2 percentage points higher than those who believed that it was "fairly strong" or "very strong". The questionnaires find that the consumption rose steadily, but was slightly inadequate.

3. The production capacity of some sectors is redundant, and production capacity utilization is low.

Fast growth in investment in recent years has to a certain extent caused partial capacity surplus. The survey finds that 44.9% of the surveyed believed that the capacity surplus existed in their sector, but it was not serious, and 24.2% believed that it existed in their sector and the problem was very serious. In terms of sectors, the capacity surplus problem was serious in textile, pharmaceuticals and non-ferrous industries. More than 35% of the respondents believed so.

The degree of capacity surplus can also be reflected in the capacity utilization. The questionnaires show that the average utilization rate of manufacturing enterprises is 77.2%. That is to say, nearly 23% of the capacity laid idle. In manufacturing sector, 35.5% of the enterprises' capacity utilization is less than 75%; more than one-third of them use three-fourths of the production capacity. The enterprises with 75-90% and more than 90% of their capacity utilization make up 41.5% and 23% respectively. Industrially speaking, pharmaceuticals, transport equipment, instruments, papermaking, plastics, electrics and machinery reported lower capacity utilization. More than 40% of them have less than three-fourths of capacity utilization.

...

If you need the full context, please leave a message on the website.

--------------------------------------------------------------------------------

* This is a follow-up report of the "Survey on Chinese Enterprise Operators'questionnaires 2006".