Economic Performance in 2007 and Development Trend in 2008

May 06,2008

Lu Zhongyuan, Zhang Liqun, Li Jianwei & Chen Changsheng

I. Review of Economic Performance in 2007

In 2007, the Chinese economy maintained a steady and rapid development, with control over demand being further improved, supply further enhanced, aggregate balance continually ameliorated and the basis for keeping prices at a lower level being constantly bolstered. In terms of mid- and long-term development, a pattern of high growth with lower prices could be maintained. The major problems were: production and circulation of agricultural and food products could not adapt to the economic development and to the improvement of the people's living standard; integration of excess liquidity into housing and stock sectors resulted in serious latent perils.

1. Overall economic performance

(1) The economy maintained a fast and steady growth. For the whole year of 2007, the Gross Domestic Product (GDP) amounted to 24,661.9 billion yuan, registering a growth of 11.4% over last year, up by 0.3 percentage points; and the quarterly growth registered 11.1%, 11.9%, 11.5% and 11.2%, respectively. Agricultural production grew steadily, with grain yield topping 1,000 billion jin, thus realizing a harvest in four consecutive years. With various policies being gradually implemented, pig production was being resumed and the total output of pork, beef, mutton and poultry meat continued to increase.

(2) Coordination in economic growth was ameliorated and investment growth stabilized at a higher level. During the whole year of 2007, the fixed asset investment in the whole society amounted to 13,723.9 billion yuan, registering a growth of 24.8% from a year ago, up by 0.9 percentage points; consumption increased fast, with the total retail volume of the social consumer goods during the whole year amounting to 8,921 billion yuan, registering a growth of 16.8% over the previous year, up by 3.1 percentage points; a downward adjustment of export growth was carried out from a higher level, and the exports in foreign trade reached US$1218 billion during the whole year, up 25.7%, down 1.5 percentage points. To sum up, the demand structure showed an evident change from being driven mainly by investment and export to being propelled by consumption, investment and export.

(3) Economic performance saw a marked improvement. Profits of enterprises and financial revenues all continued to increase by a wide margin. During January-November, the industrial enterprises above designated size across China realized a profit of 2,295.1 billion yuan after earnings balanced losses, up by 36.7% year-on-year; during 2002-2006, profits of enterprises witnessed an average annual increase of 35% and above. During 2004~2006, increase in financial revenues in the same years went up from 500 billion yuan to nearly 770 billion yuan, and in 2007 the financial revenue topped 5000 billion yuan, with a net increase of 1,000 billion yuan.

(4) Positive results were acquired in energy saving and discharge reducing. The energy consumption per unit GDP was estimated to drop by 3% or so as compared to last year, and total discharging volume of both sulphur dioxide and chemical oxygen demand saw a decline for the first time in recent years.

(5) The people received greater material benefits. Incomes of urban and rural residents increased substantially. In 2007, the per-capita disposable income of urban and township residents reached 13,786 yuan, up 17.2% from a year ago, after allowing for price rise, a growth of 12.2%, up by 1.8 percentage points. The per-capita net income of rural residents amounted to 4,140 yuan, up 15.4% over last year, after allowing for price rise, a growth of 9.5%, up by 2.1 percentage points. The number of newly employed people in cities and towns during 2007 amounted to 12.04 million, with 200,000 more than in 2006; at the end of 2007, the registered unemployment in cities and towns showed a rate of 4.0%, falling 0.1 percentage point over last year.

2. A correct understanding of the sharp rise in household consumer prices

In the economic performance of 2007, the major issue was the obvious rise in consumer prices. An objective analysis of the causes for the revealed problems favors an exact judgment of the situations, conduces to summing up experience and drawing lessons and is favorable for enhancing the government’s foresight in macro-regulation.

(1) Rise in household consumer prices was the structural inflation caused by rise in some food prices

In 2007, the CPI went up 4.8%, year on year, and in December it surged 6.5%. People became more worried about the economic overheat due to price rise and the continuous and rapid economic growth. Whether the gap between supply and demand was widened by the continuous and rapid economic growth that led to a sharp price rise, the analytical conclusion is negative.

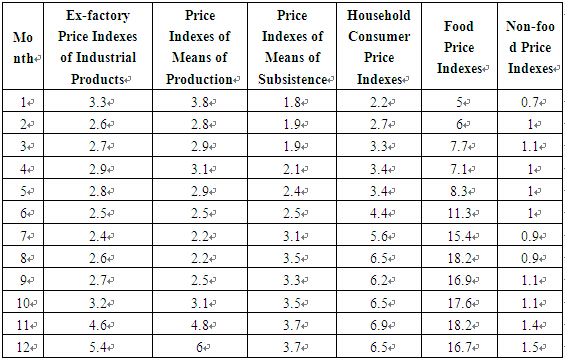

The sharp rise in consumer prices in 2007 was not caused by the disequilibrium in aggregate supplies and demands but by rise in some food prices. It can be seen from the change of the main price indexes (See table below) that among the ex-factory prices of the industrial products, growth of price indexes of the means of production continued to decline, while price indexes of the means of subsistence closely related to food products continued to go up and, as food products occupied a smaller proportion in all social products, the ex-factory price indexes of the industrial products (including price indexes of means of production and price indexes of means of subsistence) showed a decline in their growth by and large. Of the consumer price indexes, non-food price indexes maintained a growth rate of 1% or so, remaining stable; food price indexes continued to rise and stepped up the consumer price indexes. The relationship between different price indexes clearly suggested that rise in food prices was the root cause for the price rise in 2007.

Main Price Indexes (in the same month, year on year, %)

From January-December 2007

The above analysis shows that price rise in 2007 was a structural inflation rather than a disequilibrium between aggregate supply and demand, nor was it an economic overheat.

…

If you need the full text, please leave a message on the website.