The New Round of Farm Product Price Hikes: Impacts and Suggestions

May 06,2008

Cheng Guoqiang, International Cooperation Department of DRC

Research Report No.249, 2007

Farm products in China entered a new round of price fluctuations in the fourth quarter of 2006. As the basis for all other prices, the prices of food and other farm products have a direct impact on the overall price level and affect the sustained, healthy and steady development of the economy and society as a whole. By illustrating the unique features of the new round of farm product price fluctuations, this article analyzes and evaluates the impacts on the consumer price index and the macro-economy.

I. Unique Features of the New Round of Farm Product Price Hikes

In nearly three decades from 1978 to 2006 since China began reform and opening up, the country experienced five rounds of farm product price fluctuations. Beginning in the fourth quarter of 2006, China entered the sixth round of farm product price fluctuations. Compared with the previous rounds, the current round has demonstrated some new features.

First, the form of expression is different. In the past, price fluctuations were mainly manifested in the rise in the grain price. This round, however, was first manifested in the rise in the pork price, which then triggered a sweeping hike in the prices of poultry, eggs, aquatic products and other food items. The pork price bottomed out in the first half of 2006 and began a continuous pickup. By May 2007, the pork price in some southern cities became visibly higher. Within a short time, the price rise spread northward and kicked off a sweeping hike across the country. In the first half of 2007, the pig price on average was RMB 5.68 yuan for half a kilo, which was RMB 1.77 yuan or 45.2% higher than a year before. It was even RMB 1.25 yuan above the record high posted in 2004. On the other hand, the prices of food and other farm products were all lagging behind the hike in the pork price. For example, soybean and corn only saw their prices beginning to soar respectively in August and October in 2006.

Second, the formation is different. The rise in the prices of farm products in 2003~2004 was mainly led by a rise in the grain price. While the grain price rose 26.4%, the meat price was only up 17.6%. The current round, however, was led by a rise in the meat price. From October 2006 to June 2007, the pig price rose from RMB 4.05 yuan to RMB 6.4 yuan for half a kilo, up about 58% within eight months. During this period, the prices of soybean and corn were respectively 32.8% and 22.1% higher.

Third, the market supply-demand environment is different. The hike in the grain price in 2003~2004 was triggered by a continuous fall in the grain output and an acute contradiction between supply and demand. The new round of grain price hikes since the fourth quarter of 2006 occurred in a market environment featuring a three-year bumper grain harvest and a supply-demand equilibrium. By September 2007, the producer prices of paddy, wheat and corn were respectively 8.5%, 10.5% and 15.6% higher year-on-year. Since then, the grain price has been moving continuously at high levels.

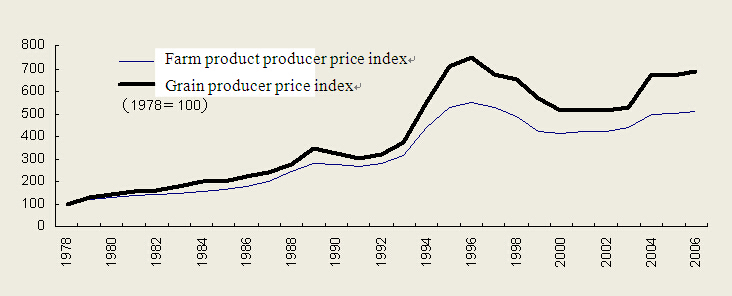

Fourth, it has the feature of a price pickup. As the following Figure shows, if the producer price index of farm products in 1978 was used as the base figure 100, the index peaked at 550 in 1996. But beginning in 1997, the prices of farm products went into the doldrums for seven years running and bottomed out only in the second half of 2003. Despite a continuous rise in the prices of farm products since 2004, the price index in 2006 was only 508.9, still below the 1996 level. In the new round of price hikes, only the pork price has been close to the level posted 10 years ago. The overall level of the prices of farm products has remained below the 1996 level. Therefore, this new round has the tangible feature of a price pickup.

Farm Product Price Fluctuations: 1978~2006

Because the supply-demand situation of the domestic and foreign markets and the environmental impacts are different, the new round of farm product price hikes has a fairly complex formation mechanism. In short, it has the following causes:

1. A tangible induction role of international price hikes

For example, China opened its soybean market in 1996 and imported 28.27 million tons in 2006, which accounted for 64% of its soybean consumption and 44% of world's total soybean import and turned the country into the largest soybean importer in the world. Currently, China's domestic soybean market has a tangible relationship with the soybean price on the Chicago Board of Trade. A 10% price rise on the CBOT can spur a 0.5% price hike on China's domestic market. Since the second half of 2006, the prices of grain and oilseeds have been rising around the world due to a fall in world grain production and a rapid development of biological energy. In April 2007, the American soybean price went up 23.7% year-on-year, which led to a 19.7% rise in the soybean price on the Chinese market.

2. A push arising from the rising production cost of farm products

Take the pig production cost for example. On the one hand, the piglet price has a tangible impact on the pork price. The low pork price in the previous years dampened the pig-farming enthusiasm of the farmers. A fall in the number of sows resulted in a drop in piglet supply. As the pork price began to rise in the second half of 2006, the farmers became more enthusiastic about pig farming and the demand for piglets rose accordingly. The undersupply of piglets pushed up the piglet price continuously. In May 2007, the national piglet price was 18.1% higher than in the previous month and 76.7% higher than in the same period of the previous year. This had a direct impact on the rise in the pork price. On the other hand, the rising cost of corn and other feeds also spurred the rise in the pork price. Analysis indicates that a 10% rise in the corn price will push up the pork price by 5.3%.

3. A pull resulting from the structural upgrading of farm product consumption

In recent years, the Chinese economy has been developing in a sustained and rapid manner. As a result, the incomes of the urban and rural residents became visibly higher and the structural upgrading of farm product consumption became faster. The sustained and rapid growth of the demand for farm products directly drove up the prices of farm products. For example, as a result of the rapid development of corn in-depth processing and especially ethanol fuel products, corn consumption has reached 23 million tons, accounting for 17% of domestic corn production. This has led to a continuous rise in the corn price, which has been moving at the high levels for four consecutive years. From October 2006 to June 2007, the corn price rose from RMB 1,324 yuan per ton to RMB 1,617 yuan per ton. The price went up 22.1% within eight months.

In addition, there are impacts induced by animal epidemics, natural disasters and other unexpected factors. For example, the epidemic of porcine reproductive and respiratory syndrome virus in the mid-2006 had forced many small farmers to quit from pig farming and many large farmers to downsize their pig farming. As a result, a sharp fall in the number of sows and in the sale of pigs triggered a drastic hike in the pork price. In July 2007, the pig price rose to RMB 13.55 yuan per kilo, which was up 73% year-on-year.

…

If you need the full text, please leave a message on the website.