Construct an Overall National Pharmaceutical Development Strategy with an Integrated Social and Economic Development

Oct 16,2008

By Wei Jigang,Research Department of Industrial Economy of DRC

Research Report No. 078, 2008

I. We Should Attach Great Importance to Current Pharmaceutical Situation

1. The international pharmaceutical situation shows that there is a great disparity in terms of pharmaceutical production and circulation between China and the developed countries and it would take China a long time to become a country with a strong pharmaceutical industry

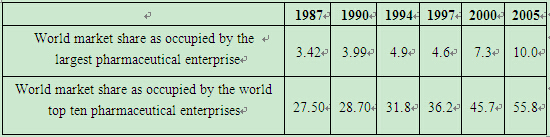

(1) Unlike the large transnational pharmaceutical enterprises and the highly concentrated world pharmaceutical markets, China's pharmaceutical-manufacturing enterprises are small in size and less concentrated, and the setup of the pharmaceutical industry is quite unreasonable. Since the 1980s, profound changes have taken place in world pharmaceutical markets. With a focus on global competition strategy and the improvement of competitive power, the transnational pharmaceutical enterprises have conducted large-scale mergers, acquisitions and restructuring, expanded the scale and market networks and formed cross-border and cross-industry enterprise giants. For example, after purchasing Warner-lambert in 2000 and Pharmacia in 2002, Pfizer has turned into the first largest pharmaceutical enterprise in the world. Transnational merger and acquisition have directly increased the concentration of world pharmaceutical markets. The sales volume of the world top ten pharmaceutical enterprises on world pharmaceutical market increased from 27.5% in 1987 to 55.8% in 2005, and the sales volume of the largest pharmaceutical enterprise on world pharmaceutical market increased from 3.42% in 1987 to 10.0% in 2005 ( Table 1).

Table 1 Concentration on World Pharmaceutical Market(%)

Global expansion has enhanced the competitive edges of the transnational pharmaceutical enterprises. A McKinsey's study shows that, due to the economies of scale and the synergy effect, the successful mergers and acquisitions among pharmaceutical enterprises can save about 15%~25% of the research and development costs, 5%~20% of production costs, 15%~50% of marketing costs and 20%~50% of administration costs for the enterprises (The McKinsey Quarterly (VI), Economic Science Press, 1998.). Global expansion has also increased the global market accession by a small number of key pharmaceuticals manufactured by transnational pharmaceutical enterprises. According to statistics, the sales volume of some dozen kinds of key pharmaceuticals has accounted for about 30% of the global pharmaceutical sales volume, of which the top ten kinds of pharmaceuticals have made up about 10% of the global pharmaceutical market shares.

The number of China's domestic pharmaceutical enterprises has generally shown a fast increase over nearly 30 years from over 800 in the beginning of 1980s and over 2000 in the beginning of 1990s to nearly 5000 in 2006. Of them,the vast majority of pharmaceutical enterprises are small in scale with limited economic scale, and the whole pharmaceutical industry is less concentrated with the organizational setup being quite unreasonable. Even the per-capita output value of large pharmaceutical enterprises is less than RMB300,000 yuan, being much lower than the level of the advanced countries. The sales incomes of China's top ten pharmaceutical enterprises only account for 10% or so of the sales incomes of all pharmaceutical enterprises, being much lower than the concentration level of the world pharmaceutical market. The sales volume of all pharmaceutical enterprises in China falls short of the sales volume of Pfizer alone.

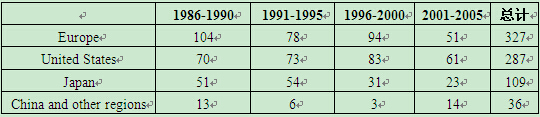

(2) The United States, Europe and Japan dominate the pharmaceutical innovation and China's pharmaceutical innovation lags far behind. According to "new chemical entities (NCEs)", the internationally recognized new pharmaceutical standard (NCEs refer to the materials that have not been ratified by the pharmaceutical authority of a country as pharmaceuticals before they are activated. And the global NCEs refer to the activated ingredients that have at least not approved or marketed by major industrialized countries.), the majority of new chemical entities across the globe are developed by a small number of developed countries. As shown by Table 2, during 1986~2005, there were 759 NCEs in all in the world. Of the total, there were 327 in Europe, 287 in the United States and 109 in Japan, which made up 95.3% of all newly developed pharmaceuticals in the world;China and other countries and regions developed 36 NCEs in all, accounting for only 4.7%.

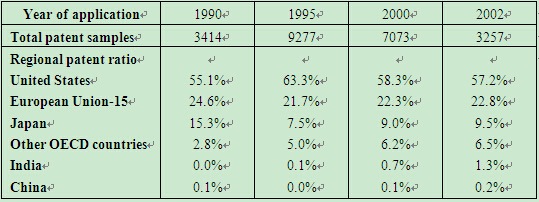

By "proportion in American patent applications", the innovation potential indicator, the United States, Europe and Japan are the most innovative in their turns. China does not have a great potential for pharmaceutical innovation and is in arrear of India in recent years (Table 3).

Table 2 Globally Approved NCEs during 1986~2005(Unit: piece)

Data: European Federation of Pharmaceutical Industries and Association, The Pharmaceutical Industry in Figures, 2006 Edition.

Table 3 Status of Various Countries in American Pharmaceutical Patent Application

Data: Iain M.Cockburn, Global Innovation in the Pharmaceutical Industry, April 2007.

Lack of pharmaceutical innovation capability and potential has caused serious shortage of products with independent intellectual property rights and has seriously restrained China's pharmaceutical industries from extending toward hi-tech and high-value-added downstream advanced processing fields;the updating and upgrading of products is slow and unable to keep up with and meet the changes in market demand in a timely way, and China-made pharmaceuticals have always remained as low-end products in international pharmaceutical division of labor, resulting in possessing a low occupancy of international market, and besides the Chinese domestic high-end pharmaceutical markets have been mainly occupied by imported or joint venture products as well. …

If you need the full text, please leave a message on the website.