China's Real Estate Market: Analysis of the Influence Exerted by the New Macro-control Policy and Relevant Policy Options

Oct 21,2010

By Liao Yingmin, Research Institute of Market Economy of DRC

Research Report No 73, 2010

I. Backdrop for the Promulgation of the New Macro-control Policy

1. The real estate market showed a steady performance in January and February of 2010

At the end of 2009, the Central Government successively unveiled a series of real estate macro-control policies aimed at containing speculation and the excessively fast price rise. In the beginning of 2010, marked effects began to show up. From January to February, the area of sold commercial housing increased by 36.6%, year on year, down by 7.3 percentage points over the previous year. In February, although sales price of newly built homes in 70 large and medium-sized cities rose by 13.0% from a year earlier and by 1.3% month on month , yet down by 0.4 percentage points over January;the month-on-month increase of the sales price of second-hand homes reduced by 0.5 percentage points in January, leading to the slowdown of volume of business and housing price rise.

2. Housing price rose rapidly in March in quite a number of cities

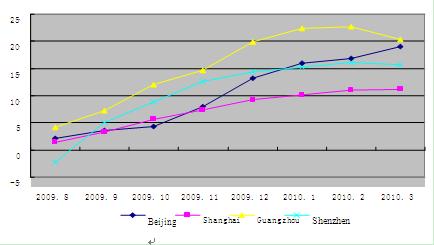

However, changes took place on the real estate market since March. Particularly, after March 15, the land auction price constantly scaled new heights in Beijing and three "new land giants" turned up through the auctions, driving up the nearby housing prices one after another and changing the market expectations in no time. Subsequently, land auction prices constantly increased in Hangzhou, Fuzhou and Changchun, and the housing markets rebounded evidently in such first-tier cities as Beijing. In the last week of March, among 12 newly opened premises in Beijing, 5 were sold out on the same day when the premises opened. In March, the business volume of the newly built commercial housing increased by 48.5% over February, with the average quotation reaching 25,337 yuan/M2, up by 34.5% over the February average. In March, the aggregate business volume of the second-hand housing was 1.23 times that of January and February, with the average transaction price reaching 14,650 yuan/M2 or so, up by 8.8% over the end of February. Sales of homes became robust and housing prices rose drastically in cities like Shanghai, Shenzhen and Guangzhou. According to the National Bureau of Statistics, in March, prices of newly built homes in Beijing, Shanghai, Guangzhou and Shenzhen increased by 19.1%, 11.2%, 20.3% and 15.7% respectively over the same period of the previous year (See Figure).

|

|

Year-on-year Changes in Prices of Urban Newly Built Homes in Cities like Beijing from August of 2009 to March of 2010 (%) |

Source: Based on the data released by the National Bureau of Statistics

3. The housing price hikes spread rapidly and the market situation is quite grim

What merits attention is that the rapid housing price rise has begun to transmit and spread from first-tier cities to second- and third-tier ones. According to the National Bureau of Statistics, in March, sales prices of the newly built homes in 23 second- and third-tier cities increased by more than 10% from a year ago and the increase in both quantity and prices cropped up. Nationally, from January to March, the area of sold commercial housing reached 153.61 million square meters, up by 35.8%, year on year. Of this total, the sold area reached 82.06 million square meters in March, being 1.15 times that of the sum total of January and February, up by 16.4 percentage points to 32.8% over the same period of last year. In March, prices of newly built homes in 70 large and medium-sized cities increased by 14.2%, year on year, up by 1.2 percentage points over February and by 16.1 percentage points over the same period of last year, and the sales prices of newly built homes all mounted up in 70 large and medium-sized cities. And sales prices of second-hand homes increased by 9.5%, year on year. From January through March, the average composite sales price of commercial housing came to 5193 yuan, up by 16.1% from a year earlier. The excessively rapid housing price rise and the high price level in 2009 have resulted in unreasonable home leasing and sales price ratios and housing price-to-income ratios in some cities, suggesting the appearance of the real estate bubble. The present rapid housing price rise will boost the continuous growth of the real estate bubble to make a growing number of average residents unable to afford the homes and to arouse panic among the public, leading to worsened social effects and the risk of real estate bubble bursting.

II. Analysis of the Causes for This Round of Housing Price Rise

Analysis shows changes on the real estate market and the housing price hikes have been the result of the composite impacts from various factors.

Firstly, the constant land price rise has driven up the housing prices.

Land is the essential factor for the housing construction and the land cost makes up about more than one third of the total housing cost. Since land resources for housing construction are limited in China, the land reserves to be developed by real estate development enterprises at the end of 2009 decreased by 32.4% over the previous year, making such enterprises to vie fiercely for land resources. In addition, the handsome investment earnings gained by real estate enterprises over recent years have attracted more social funds to invest in the real estate sector. Newcomers in the real estate sector need land resources at first, which keeps the bidding, auctioning and licensing land prices skyrocketing. Consequently, the land price rise has furthered the rapid housing price rise in neighboring areas and has constantly driven up the housing price level on the whole market, thus becoming a lead-up to this round of housing price rise.

…

If you need the full text, please leave a message on the website.